Accept Apple Pay for Business

Offer Frictionless Recurring Payments and Boost Profits

By choosing to accept Apple Pay, businesses can offer frictionless recurring payments and boost profits. Now, more than ever, digital wallets are an asset for customers since they streamline purchasing, store a range of cards, accounts, and other items in a single application, and provide enhanced security for purchases. Apple Pay is the most widely used digital wallet and is accepted by brick-and-mortar business and online stores alike. With new features that streamline processes for subscription-based businesses, you can leverage the simplicity and ease of Apple Pay for your online transactions.

In this article, we’ll review what digital wallets are, how they’re used, how to accept Apple Pay, and its position in the market. We’ll also look at how Payway can simplify your Apple Pay integration so you can start reducing cart abandonment and card decline rates fast.

What are digital wallets?

Think of what’s in your wallet. Does it keep your driver’s license safe? Your debit and credit cards? A gift card from your birthday two years ago next to tickets for a show next month and a crumpled boarding pass from a flight three weeks ago?

Digital wallets keep the same information in one place, just in digital form. Wallet applications store your payment information, passwords, and other items on your devices so you can complete online transactions easily with the information on hand and ready to go. Some things you can store in a digital wallet include:

- Credit cards

- Debit cards

- Bank account information

- Prepaid gift cards

- Membership and loyalty cards

- Drivers’ licenses and other forms of identification

- Plane and train tickets

- Event tickets (for venues that support digital wallets)

- Digital car keys

There are several benefits to providing digital wallet payments as an option for your customers. They simplify and expedite the transaction process and reduce your card abandonment and card decline rates. Digital wallets also let customers leverage loyalty points and other perks while providing additional purchase security.

What is Apple Pay?

Apple Pay is a digital wallet service on Apple devices, including iPhones and iPads. With Apple Pay, users can easily store their payment information to make purchases without manually entering their card or account information. Apple Pay is fast to set up, allows users to leverage their card’s benefits and rewards without obstruction, and offers contactless payments for in-person transactions and supporting online purchases.

With a simple interface, reliable security and evolving features, Apple Pay has consistently added value and gained traction since its debut in 2014. Since then, Apple Pay has become standard across all iPhone, iPad, Apple Watch, and Mac models, driving its astounding growth.

Why should you Accept Apple Pay?

Adding Apple Pay as a payment method for your customers is a good move, given that digital wallets are a popular way to simplify and secure purchases for your customers. Here’s why we believe adding Apple Pay to your payment gateway isn’t just a smart move, but a necessary one.

Popularity

Apple Pay is accepted as a contactless payment option by 85% of U.S. retailers, and 44% of U.S. customers have an Apple Pay-enabled device. It has experienced the fastest growth among digital wallets; nearly half of all in-store digital wallet purchases are made using Apple Pay.[1]

Today, Apple Pay dominates the digital wallet market with 43.9 million users while its closest competitor, Google Pay, trails with only 25 million users.[2]

Secure payment method for your customers

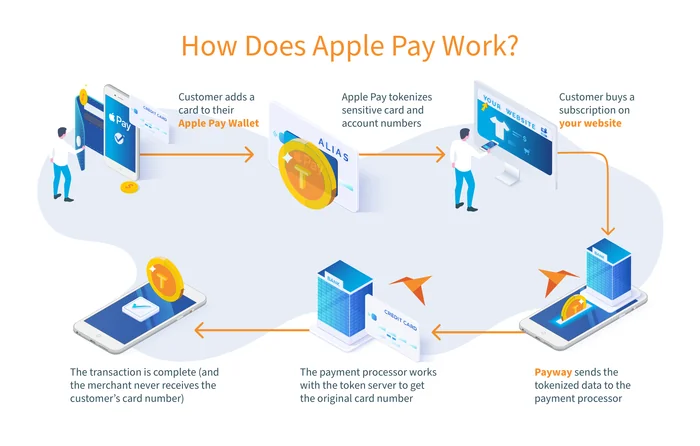

Digital wallets add an extra layer of security for your customers. When a customer adds their card to a digital wallet, the program protects their sensitive account information with secure replacement data in a process called tokenization. Apple Pay replaces their card number, CV number, and expiration date with surrogate numbers that map back to the tokenization system when a customer makes a purchase. That means merchants receive payments without sensitive information and customers gain peace of mind when making purchases and setting up subscriptions.

Apple Pay is here to stay

As one of the most secure digital wallets, Apple Pay is one of the safest ways to pay online. As a result, experts expect its growth to continue with a projected 51.5 million users by 2024. The service is particularly popular among Gen Z consumers who use Apple Pay more than any other generation and adopted contactless and mobile purchases en masse during the COVID-19 pandemic.

As tech-savvy customers become more and more prevalent, the use and ubiquity of digital wallets will continue to increase. Leaders in the tech space agree that, as an alternative to Google Pay that’s available across Gen Z and Millennials’ preferred devices, the use of Apple Pay will continue to expand.[3], [4] Its popularity alongside Apple’s growing smartphone market share (55.79% in 2023) means that it is here to stay, so integrating Apple Pay at checkout for your customers is a smart move.

Why choose Payway to process recurring payments with Apple Pay?

Unlike finding the right payment processing solution for your subscription-based business, adding new payment methods to meet your customers’ evolving needs is an ongoing task. Adding Apple Pay as a method gives your customers various secure payment options from a single source. But it doesn’t just make purchasing easier for your customers—it protects you from cart abandonment and declined recurring payments.

Recurring payments present unique challenges, especially when card numbers change or expire. In the past, when a customer made a payment with Apple Pay, the merchant would receive a device token. With this token, they could decrypt the card information and accept payment, but if the user removed the card from their Apple Pay wallet or swapped devices, the merchant could no longer charge the card. In this scenario, Apple Pay recurring payments could not be completed, leading to around 20% decline rates for subscription-based businesses.

Now, in 2023, that’s all changed. As an Apple Pay service provider, Payway can now provide merchant tokens that attach the customer’s card to their recurring subscription instead of their device. So when your customers change their digital wallet settings or get new devices, their subscription payments continue uninterrupted.

And with Payway’s Account Updater and Amex Cardefresher, you can avoid lost sales due to expired card numbers or changed accounts. Account Updater and Amex Cardrefresher help protect and ensure revenue by avoiding failed transactions by querying Visa and Mastercard to update changed and outdated account information.

How to integrate Apple Pay with Payway

Adding Apple Pay as an option for your customers is a smooth way of providing frictionless payments while supporting your subscription sales and protecting revenue. With Payway, you’ll use the RESTful API to process Apple Pay transactions.

The integration, handled by JavaScript provided by Payway, can be customized to your specific needs to give your customers a seamless checkout experience. Our JavaScript includes all the required information to communicate with PaywayWS, decrypt Apple Pay information, and process payments. In addition, Payway’s systems handle all the cryptography and security certificates with Apple Pay and provide you with standardized JavaScript that you can modify to support your custom payment sheet that’s shown to your customers.

However, if you require more flexibility, you can implement your own Apple Pay gateway integration to send decrypted Apple Pay payloads directly to PaywayWS for processing.

Setting up your Apple Pay payment gateway integration is a straightforward four-step process outlined in our Apple Pay Integration Guide. With Payway’s concierge support team available to help you, we’re confident you’ll provide elevated payment options to your customers in no time! Explore our resources for Apple Pay or contact us to begin your journey to simple and secure digital wallet payments.

Summary

Apple Pay is a popular, powerful digital wallet service that offers online purchase security and ease for customers and merchants. Payway, an Apple Pay service provider, allows merchants to collect recurring payments with enhanced functionality and easy implementation. With a simple setup for integration and concierge support, you can add Apple Pay as a secure payment method for your customers, decreasing card decline rates and supporting the completion of recurring payments.

[1] Google Pay vs. Apple Pay vs. Samsung Pay – business.com

[2] Google Pay vs. Apple Pay vs. Samsung Pay – business.com

[3] How Many People Use Apple Pay in the US? [Updated Jan 2023] (oberlo.com)

[4] How Apple captured Gen Z in the US — and changed their social circles | Financial Times (ft.com)