Understanding Secure Payment Processing

Protecting your customers’ data and your own is paramount in today’s threat-ridden landscape. With data breaches on the rise, you’re probably wondering how to protect your customers’ sensitive information. How can you manage all the factors involved in selecting the right payment processing solution for your business while ensuring your solution’s security can withstand a data breach attempt?

This article will review why payment gateway security is vital, how secure payment processing works and how you can ensure your gateway meets or exceeds current best practices.

Why prioritize security?

Online security issues go beyond SSL certificates and phishing emails. Bad actors (previously called hackers) have advanced their tactics for infiltrating organizations worldwide to steal internal company data and your customers’ sensitive information, including payment details. With so much at stake, data breaches can considerably impact any size business.

You work hard to build customer loyalty and trust, but a data breach can lead customers to your competitors while you try to mitigate the fallout. In fact, it takes around 277 days on average to identify and contain a data breach, and the average cost of a breach rose 2.6% between 2021 and 2022 to $4.35 million.[1]

The impact of a breach goes beyond damaged trust however, and can extend to:

- Short- or long-term business disruption

- System downtime while your team remedies vulnerabilities

- The cost of lost customers and new customer acquisition

- Diminished goodwill

As you can see, data breach costs more than money. So how can you prevent a breach before it starts?

- Adopt a zero-trust security model: Prevent unauthorized individuals from accessing sensitive data.

- Protect your cloud data: Deploy data encryption and a data classification schema to hide sensitive data from unauthorized eyes.

- Ensure your tools are secure: Assess your tech stack and ensure each piece of software and hardware meets your business’ security goals. This includes your payment gateway, which processes customers’ sensitive information.

Protecting your customers’ identification and payment information is vital, as compromised card and account details can result in lost funds, bank disputes and identity theft. Ensuring your payment gateway is secure is a huge component of preventing data breaches.

How does secure payment processing work?

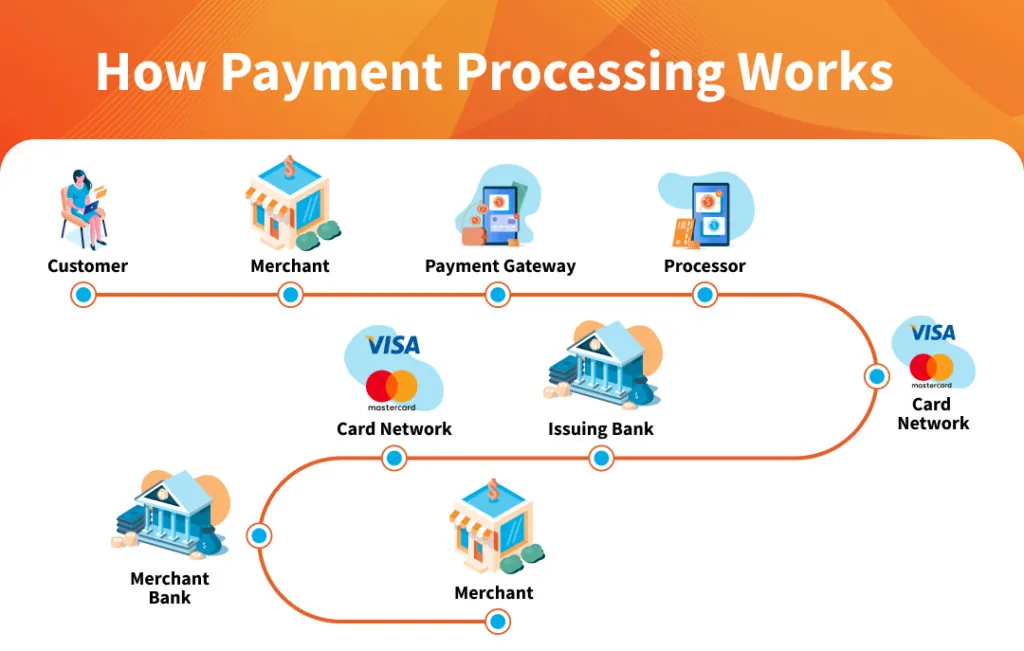

Payment gateways act as a secure link between your website and payment processors. Processors connect merchants to card networks like Visa and Mastercard to accept both credit and debit card payments.

The three primary functions that keep data secure are embedded within these steps: authorization, tokenization and encryption.

During authorization, the issuing bank verifies and approves your customer’s card details. Then, based on the purchase amount, the transaction is approved or declined. During this process, the issuing bank also verifies the card’s validity using address verification and card security codes to ensure all information matches the information on file.

Throughout this process, your payment gateway tokenizes sensitive data. Tokenization replaces your customer’s primary account and card numbers with a unique value that only your payment gateway can decrypt. That means your business’ servers do not house your customers’ sensitive data; it is stored on a highly secured server instead.

With added encryption, your customers’ sensitive details are never revealed or stored on your server, reducing the overall cost of PCI DSS compliance—the industry standard for data security.

What are the standards for secure online payment processing?

The Payment Security Industry Data Security Standards (PCI DSS) are the gold standards for data protection. Major credit card brands require payment gateways and processors to adhere to these standards to ensure each merchant meets the minimum requirements for securing cardholder data.

If your business uses a payment gateway, you must ensure it is PCI DSS compliant to reliably accept payments and, more importantly, protect your customers’ data. Non-compliance can cause a collection of complications:

- Risk of a data breach: Meeting PCI DSS compliance ensures you meet the minimum requirements for protecting cardholder information.

- Non-compliance penalties: Accepting payments without minimum payment security can result in hefty fines, penalties and legal fees.

- Damaged reputation: If your company faces legal action around online payment processing, you could experience reputational damage and customer loss.

PCI DSS compliance is more than a legal requirement—it’s a necessary step to protect the integrity of your payment system and your customers’ sensitive data. By adhering to the PCI DSS standards, you show your customers that you’re committed to their data security, which can improve your overall brand image and your customers’ confidence and loyalty.

How does Payway provide payment security?

Whether you’re looking for your business’ first payment gateway or want to upgrade your existing one, security should be the first feature you assess. At Payway, security is baked into each component of our payment gateway to give you (and your customers) peace of mind with every transaction. We know each business has unique payment and security needs, so we provide a range of options so you can meet your security and compliance goals.

Complementary tokenization and vault technology:

Every Payway customer receives complimentary tokenization to protect your customers’ data and expedite recurring payments. Primary account numbers are replaced with a token only Payway can recognize. The original account numbers are stored in one of our two data centers hosted by Armor, a PCI compliant cloud-based facility.

Point-to-point encryption (P2PE):

Through our partner Bluefin, Payway offers encryption that protects cardholder data from potential hackers. With P2PE enabled, you never receive your customers’ data, making it easier to achieve PCI DSS compliance.

3D Secure:

3D Secure for eCommerce allows secure communication between the merchant website, card issuer and cardholder as necessary. Added authentication provides fraud protection, increases authorization rates and shifts chargeback liability from the merchant to the issuing bank.

Secure Payment Solutions Are Within Reach

Payment processing security can be complex, but ensuring your business meets its secure online payment processing goals is simple with a customizable gateway. Payway’s concierge support team is on hand to help you implement security features and address concerns 24/7. Contact our sales team if you’d like to learn more about Payway’s secure payment gateway, contact our sales team.

[1] IBM “Cost of a Data Breach Report 2022”: 3R8N1DZJ (ibm.com)