Payment Gateways and Merchant Accounts: Why You Need Both for Seamless Payment Processing

Online businesses thrive on the ability to accept payments swiftly and securely. Two crucial components in this process are payment gateways and merchant accounts. While they may seem similar, they serve distinct roles in payment processing. In this article, we’ll unravel the differences between payment gateways and merchant accounts and shed light on why having both is essential for any type of business.

What is a Payment Gateway?

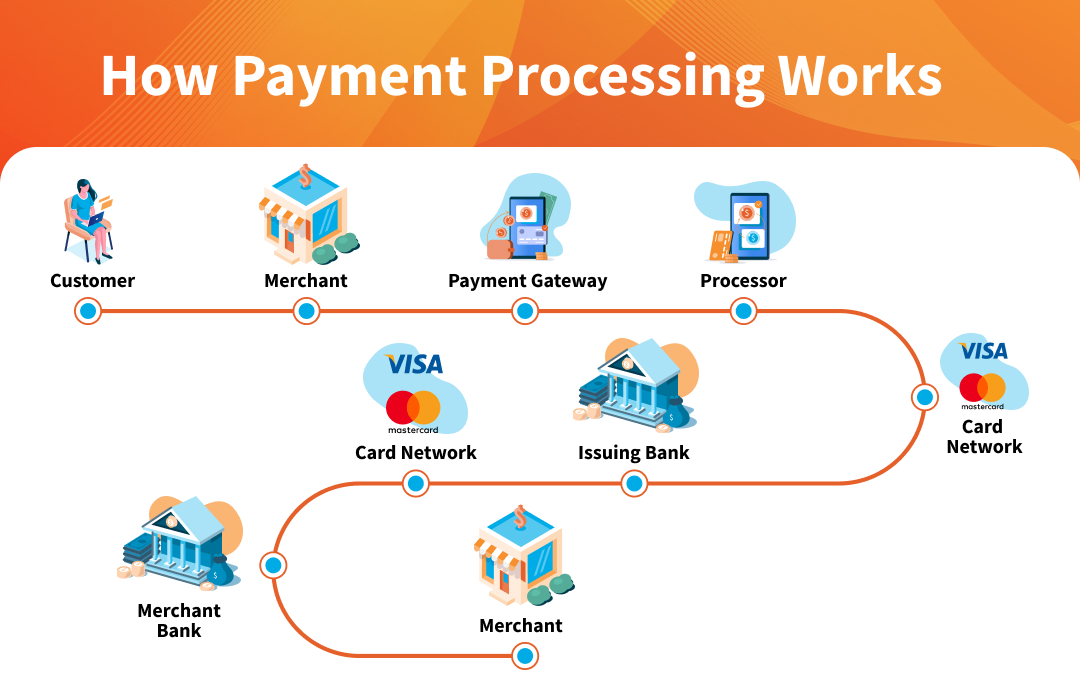

A payment gateway is the virtual equivalent of a cashier at a brick-and-mortar store. It’s the intermediary responsible for securely transmitting customer payment information to the merchant’s bank for authorization and processing. Think of it as the bridge connecting the customer’s card or payment method to the merchant’s bank account. Here’s how it works:

- Customer Initiates Payment: When a customer decides to make a purchase on your website, they enter their payment details, such as credit card information, into your payment gateway.

- Encryption and Security: The payment gateway encrypts this sensitive data, ensuring it remains confidential and secure during transmission.

- Authorization Request: The payment gateway forwards an authorization request to the issuing bank (the bank that issued the customer’s credit card).

- Authorization Response: The issuing bank either approves or declines the transaction based on factors like available funds and fraud checks.

- Transaction Completion: If approved, the payment gateway informs your website that the payment was successful. The customer receives a confirmation, and the transaction is complete.

Merchant Account: Your Earnings Repository

On the other hand, a merchant account is where the funds from successful transactions are temporarily held before they are transferred to your business bank account. It acts as a financial holding area for your earnings. Here’s how it fits into the payment process:

- Transaction Settlement: After the payment gateway secures authorization, the funds from the sale are deposited into your merchant account.

- Hold and Processing: The money remains in the merchant account for a brief period, typically a few days, during which the payment processor performs various checks and fraud prevention measures.

- Transfer to Business Bank Account: Once the holding period is over, the funds are transferred from the merchant account to your business bank account, making them accessible for your use.

To get a merchant account, you’ll need to apply. Payway Merchant Payment Services can assist you in selecting the merchant account as well as the completion and submission of your application. However, if you already have a merchant account, the harder work is done! You just need the payment gateway. Some payment gateways require you to use a merchant account with a specific bank while others, like Payway, do not.

Why You Need Both

Payment gateways and merchant accounts go hand in hand and are needed in order to accept payments. However, they are very different and play different roles within the payment process. While a payment gateway routes the payment transaction information to the processor, a merchant account allows a businesses to receive the funds from these transactions. Let’s look at why you need both components to run a business:

- Security: Payment gateways are responsible for securing sensitive customer data, while merchant accounts ensure that funds are deposited safely into your business account. This dual-layered security is vital for building trust with your customers.

- Transaction Management: Payment gateways manage real-time transactions, authorizing payments instantly. Merchant accounts handle the settlement and subsequent transfer of funds, helping you manage your cash flow efficiently.

- Chargebacks: Merchant accounts come into play when dealing with chargebacks (disputed transactions). Funds are deducted from the merchant account to cover chargeback costs, protecting your business from financial losses.

- Customization and Reporting: Payment gateways often offer customization options for the checkout process, while merchant accounts provide detailed transaction reports and insights. This data is invaluable for optimizing your business strategy.

Payment Service Providers as an Alternative to a Merchant Account

It’s not uncommon for start-ups to use a payment service provider (PSP) to handle the merchant account and payment gateway set up. A PSP refers to a third-party company that provides payment services to businesses that accept online payment methods. Examples of PSPs include Amazon Pay, PayPal, Stripe, and Square. With a traditional merchant account, the merchant has its own account. A PSP, on the other hand, combines a variety of different merchants under a single umbrella account. So, instead of getting a specific merchant ID number through a processing bank with a merchant account, you get a license to process payments through the PSP merchant account. You become what’s known as a “sub-merchant.”

For more information on what’s best for your business, read Merchant Accounts vs. Payment Service Providers: Which Should You Choose?

In conclusion, payment gateways and merchant accounts are two integral components of online payment processing. While payment gateways facilitate secure transactions, merchant accounts ensure the smooth flow of funds. To provide a seamless and secure payment experience for your customers while efficiently managing your finances, you need both these tools working together.