What is Interchange Pass-Through Pricing?

And how it differs from bundled pricing

Interchange pass-through pricing may be one way your business can realize savings in payment fees of up to 20%. There are several payment models an issuing bank may charge you for opening a merchant account. In this blog, we will review two; interchange-pass through pricing (also known as cost-plus pricing) and bundled pricing (also known as flat fee pricing).

Interchange Pass-Through Pricing

Interchange pass-through pricing is a transparent way for payment processors to charge merchants for credit card processing. Under this model, the merchant pays:

Interchange Fee + Assessment Fee + Processor’s Markup

Here’s what each part means:

- Interchange Fee:

This is the fee set by the credit card networks (Visa, Mastercard, etc.) and paid to the card-issuing bank. It’s based on factors like card type (credit vs. debit), how the card is used (in-person vs. online), and the industry of the merchant. - Assessment Fee:

A small fee charged by the card networks themselves, typically a percentage of the transaction. - Processor’s Markup:

The fee your payment processor charges you for handling the transaction. This is typically a fixed amount per transaction (e.g., $0.10) and/or a small percentage (e.g., 0.15%).

For Example:

Let’s say:

- Interchange fee = 1.80%

- Assessment fee = 0.13%

- Processor markup = 0.20%

For a $100 transaction, you’d pay:

- $1.80 (interchange)

- $0.13 (assessment)

- $0.20 (markup)

Total: $2.13

Payway uses interchange pass-through pricing for businesses that want to open their own merchant account. This means we pass through the interchange fee rather than bundling it into one flat fee per transaction. An interchange fee is a payment processing fee determined by the card network (Visa, Mastercard, Discover, etc.) and collected by the issuing bank (the financial institution that issued the credit card). The responsibility of the card network is to provide the communication system between the merchant and issuing bank to complete a credit card transaction.

During settlement, the interchange fee (among others) is deducted from the transaction amount before it is deposited into the merchant’s bank. This fee makes up the majority of fees involved in credit card payment processing. This fee is non-negotiable and the responsibility of the merchant. There are ways, however, to save on interchange fees.

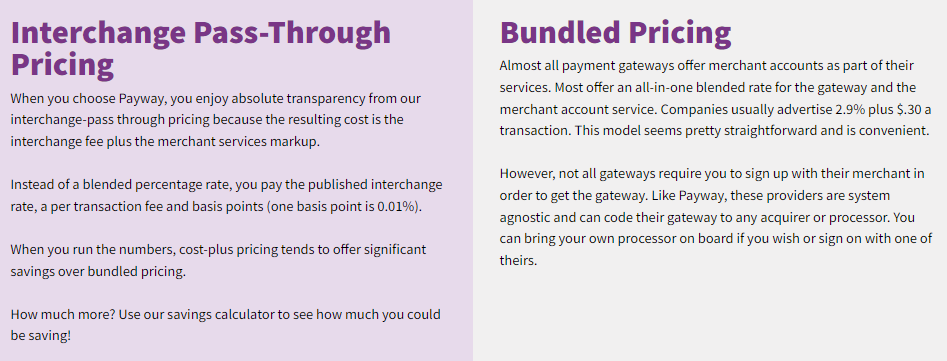

Interchange Pass-Through Pricing is Transparent & Cost Effective

This pricing model is more transparent than bundled pricing because it is far more difficult to have hidden costs. In interchange pass-through pricing, we charge the actual interchange fee then add a markup (i.e., 10 cents). With interchange pass-through pricing, you’ll know exactly what you’re paying per transaction. Interchange-plus statements provide information on the actual interchange charges and processor fees. In this way, you can understand if you are being overcharged by the issuing bank, credit card association, or merchant service provider. Interchange pass-through pricing can reduce your credit card processing fees by up to 20%.

Payment Service Providers and Bundled Pricing

If you choose to work with a payment service provider (PSP) to get a merchant account vs. applying for a merchant account on your own, you probably are paying one flat rate per transaction. A PSP, on the other hand, combines a variety of different merchants under a single umbrella account. So, instead of getting a specific merchant ID number through a processing bank with a merchant account, you get a license to process payments through the PSP merchant account. You become what’s known as a “sub-merchant.” PSPs are convenient, but they can also come with per-transaction fees that can be pretty expensive.

Many PSPs such as Stripe, Square and PayPal charge use this pricing model. Bundling pricing ensures that you pay the same amount for every transaction, no matter what the card type might be. There’s no monthly fee to worry about, and other costs beyond transaction costs or usually non-existent too. This is pricing model is better for businesses with a lower-than-average volume of payment transactions or that are trying to avoid the complexities of applications and underwriting that come with merchant account provider services.

In summary, smaller or start-ups might benefit from paying one bundled fee per transaction as it’s easier and convenient to work with a PSP using this pricing model. However, once your business has reached a certain level of steady revenue, you’ll likely discover that having a merchant account with interchange-plus pricing provides you with more flexibility and offers up new opportunities for expansion.

See how much you can save using Payway’s saving calculator.