As New Digital Channels Present Opportunities. Do They Outweigh the Risks?

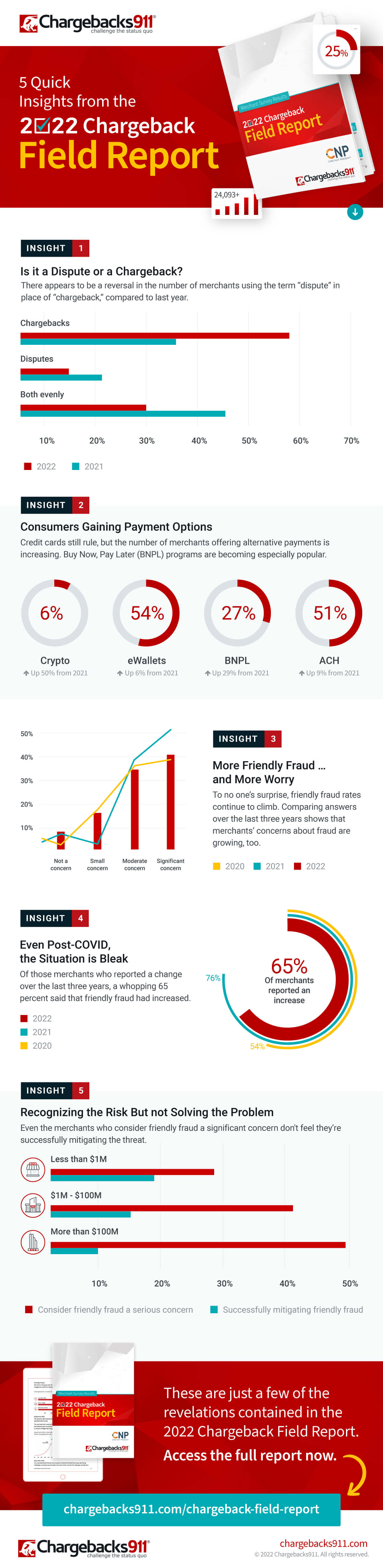

Payment disputes—more commonly known as chargebacks—have traditionally been a major concern for merchants in the eCommerce space. Most brick-and-mortar sellers, on the other hand, have limited experience with the chargeback process.

Brick-and-mortar sellers might see the occasional chargeback. However, most in-person transactions are card-present exchanges, and chargebacks from card-present transactions are fairly uncommon. That’s quickly changing, though, as we see with data from the recently published 2022 Chargeback Field Report from Chargebacks911.

New Digital Channels for Brick-and-Mortar Retail

Online orders and “click-and-collect” retail were crucial lifelines for many physical retailers during the Covid-19 outbreak. It’s no surprise that, in 2020, click-and-collect retail sales surged by 107 percent compared to the previous year. The sales channel is projected to make another 21 percent gain this year, and we should expect continued strong momentum for the foreseeable future.

Click-and-collect presents some great opportunities for brick-and-mortar retailers. Customers can shop quickly, conveniently, and safely. They can make a purchase with a few quick clicks, then pick up their goods in store. In many cases, they can make their pickup later that same day. Merchants can generate more sales without having to increase their physical retail footprint.

Like any technology, though, we have some downsides. By incorporating digital channels into the sales process, merchants open themselves up to a greater threat posed by fraud.

Following the EMV liability shift in 2015, fraudsters moved a lot of their energy online. By their nature, card-not-present transactions are inherently more susceptible to schemes like account takeover, synthetic fraud, and other criminal threats. Looking beyond criminal activity, though, we also have to account for first-party risk factors like friendly fraud.

Click-and-Collect Meets Friendly Fraud

Friendly fraud happens when a cardholder files a chargeback without a valid reason to do so. According to the Chargeback Field Report, about two-thirds of merchants saw an increase in friendly fraud attacks over the past three years. This neatly overlaps with the widespread adoption of card-not-present options for brick-and-mortar commerce.

This is a very difficult problem to manage. The study found that identifying friendly fraud and winning reversals of invalid chargebacks were the biggest chargeback management challenges facing merchants.

Larger companies were more likely to recognize friendly fraud as a serious threat. However, just 10 percent of enterprise merchants involved in the study said they were managing the problem effectively.

There has been some industry movement to try and address this problem. Innovations like Rapid Dispute Resolution from Visa, which helps resolve disputes before they become chargebacks, is seeing wider adoption. Ultimately, though, friendly fraud is going to become a bigger and bigger problem over time unless merchants are able to identify these threats and take action.

Download the 2022 Chargeback Field Report to get a full picture of the current state of dispute management and chargeback prevention.