Understanding Cost-Plus Pricing vs. Bundled Pricing

What's Best for Your Business?

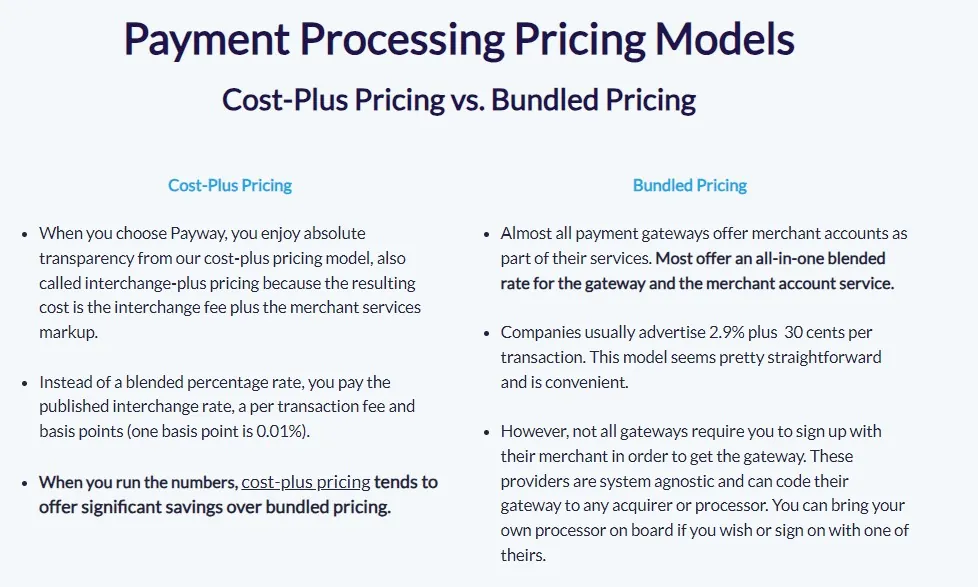

As a business owner, managing your finances efficiently is paramount to your success. One of the key financial decisions you’ll face is choosing an issuing bank for your merchant account. There are different payment models an issuing bank may charge you for opening a merchant account. Two common pricing models are Cost-Plus Pricing (also known as Interchange Pass-Through Pricing) and Bundled Pricing, often referred to as Flat Fee Pricing.

In this blog, we’ll explain these two pricing models and the differences between them. We’ll also provide guidance on what factors to consider when deciding which pricing model is best for your business.

Cost-Plus Pricing

Cost-Plus Pricing is a transparent pricing model where businesses are charged based on the actual costs associated with processing credit card transactions. These costs include interchange fees set by card networks like Visa and MasterCard, assessment fees, and the processor’s markup. Here’s how it works:

- Interchange Fees: Card networks charge interchange fees to cover the cost of processing credit card transactions. These fees vary depending on factors like card type, transaction volume, and processing method.

- Assessment Fees: Card networks also charge assessment fees, which are fixed fees per transaction.

- Processor Markup: Payment processors charge a markup on top of interchange and assessment fees as their profit margin.

The advantage of Cost-Plus Pricing is transparency. Business owners can see the exact cost of processing each transaction, making it easier to understand and control expenses.

Bundled Pricing (Flat Fee Pricing)

Bundled Pricing, on the other hand, simplifies the pricing structure by offering a flat monthly fee for payment processing services. This model typically includes all fees and charges, making it easier for business owners to budget. Here’s how it works:

- Flat Monthly Fee: Business owners pay a fixed monthly fee for payment processing services, which covers all transaction-related costs, including interchange fees, assessment fees, and processor markups.

- Predictable Costs: With Bundled Pricing, businesses know exactly how much they’ll pay each month, making it easier to budget and plan finances.

Differences Between the Two Pricing Models

Now that we’ve introduced both pricing models, let’s explore the key differences between them:

- Transparency: Interchange Pass-Through Pricing offers greater transparency, allowing business owners to see the breakdown of transaction costs. In contrast, Bundled Pricing simplifies costs into a single monthly fee, offering convenience but less visibility.

- Predictability: Bundled Pricing provides more predictable costs, making it easier for businesses to plan their budgets. Interchange Pass-Through Pricing can result in more variable monthly expenses, as costs depend on transaction volumes and types.

- Cost Control: Interchange Pass-Through Pricing allows for more granular cost control, as businesses can optimize their payment processing by understanding the components of each transaction cost. Bundled Pricing simplifies billing but may not offer the same level of cost control.

Choosing the Right Pricing Model for Your Business

Selecting the right pricing model for your business depends on several factors:

- Transaction Volume: If your business processes a high volume of credit card transactions, Interchange Pass-Through Pricing may be more cost-effective, as you can take advantage of cost savings strategies.

- Budgeting Preferences: If you prefer predictable, fixed monthly costs for your payment processing, Bundled Pricing might be more suitable.

- Understanding of Costs: Consider how comfortable you are with understanding and managing the different components of transaction costs. If transparency is vital, opt for Interchange Pass-Through Pricing.

- Industry and Business Size: Some industries may benefit more from one pricing model over the other due to specific transaction patterns and average ticket sizes. Consult with a payment processing expert for industry-specific advice.

Conclusion

Choosing between Interchange Pass-Through Pricing and Bundled Pricing is a crucial decision for business owners. By understanding the differences between these pricing models and considering your business’s specific needs, you can make an informed choice that aligns with your financial goals and preferences. Remember, consulting with a payment processing expert can provide valuable insights and help you navigate this important decision effectively. Ultimately, the right pricing model can contribute to your business’s financial health and long-term success.

Related Resources: