Understanding and Mitigating Friendly Fraud in Payment Processing

In recent years, there has been a concerning rise in incidents of friendly fraud in the payment processing industry. Despite expectations of a decline in chargeback activity after the COVID-19 pandemic, data published by Visa suggests otherwise. A staggering 75% of all chargebacks issued in 2022 were cases of friendly fraud rather than true criminal fraud. This phenomenon not only poses financial losses but also challenges the trust and integrity of payment systems. In this article, we delve into the nuances of friendly fraud, its impact, and strategies for mitigating its occurrence.

Understanding Friendly Fraud

Friendly fraud occurs when a cardholder disputes a legitimate transaction with their bank rather than seeking a refund directly from the merchant. This often stems from misunderstandings, forgetfulness, or deliberate attempts to exploit the chargeback process for personal gain. The ease of initiating chargebacks, coupled with consumer misconceptions about the process, exacerbates the issue.

The Magnitude of Friendly Fraud

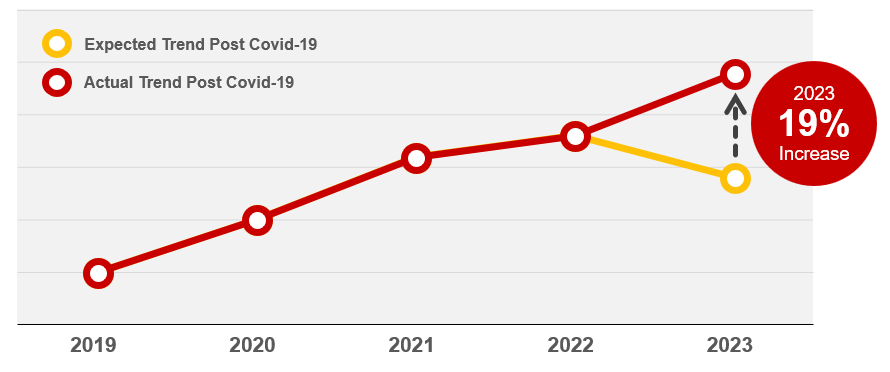

According to Chargebacks911 2023 Field report, the average reported increase in friendly fraud instances in 2023 was 19%. This is a concern considering that chargeback activity was expected to decline after the COVID-19 pandemic. Recent data published by Visa suggests that 75% of all chargebacks issued in 2022 were cases of first-party misuse (friendly fraud) rather than true criminal fraud.

Friendly fraud presents a significant challenge for merchants, with Visa data revealing that for every dollar lost to fraud, it costs $3.75. In 2023, approximately $65 billion worth of transactions were wrongfully returned through chargebacks, with 75% attributed to friendly fraud or first-party misuse. Such losses underscore the urgency for effective measures to combat this growing problem.

Factors Contributing to Friendly Fraud

Several factors contribute to the prevalence of friendly fraud:

- Consumer Perception: Many consumers perceive disputing a chargeback as equivalent to seeking a refund from the merchant, leading to misconceptions and misuse of the process.

- Convenience and Frictionless Transactions: The rise of e-commerce and digital payments has made it easier for consumers to dispute transactions with a click of a button, amplifying the risk of abuse.

- Payment Authentication: Insufficient authentication measures during online transactions increase the likelihood of unauthorized card usage and subsequent disputes.

Mitigating Friendly Fraud

To address the challenge of friendly fraud effectively, merchants and payment processors can implement various strategies:

- Enhanced Authentication: Implement multi-factor authentication and 3D Secure protocols to verify the identity of cardholders and mitigate unauthorized transactions.

- Clear Billing Descriptors: Ensure that billing descriptors accurately reflect the merchant’s identity to minimize confusion and reduce the likelihood of chargebacks due to unrecognized transactions.

- Transaction Monitoring: Utilize AI and machine learning algorithms to detect anomalies in transaction patterns and identify potential instances of fraud or suspicious activity.

- Education and Communication: Educate consumers about the chargeback process, clarify the distinction between disputes and refunds, and provide clear channels for resolving issues directly with the merchant.

- Continuous Improvement: Regularly review and update security measures, stay informed about industry regulations and best practices, and adapt strategies to evolving fraud trends.

Conclusion

Friendly fraud poses a significant challenge to the integrity and security of payment processing systems, resulting in substantial financial losses for merchants and payment processors alike. By understanding the underlying causes, implementing robust authentication measures, and fostering transparent communication with consumers, stakeholders can mitigate the impact of friendly fraud and safeguard the integrity of payment transactions. In an increasingly digital and interconnected world, proactive measures are essential to maintain trust, security, and efficiency in payment processing operations.