How Billing Descriptors Can Help Reduce Disputes & Chargebacks

Optimizing billing descriptors is one of the easiest and most effective things you can do to prevent chargebacks.

A billing descriptor is an explanation of a transaction and appears on a customer’s credit card statement. Poorly-thought-out billing descriptors are among the most common chargeback-inducing merchant errors. Optimizing billing descriptors is one of the easiest and most effective things you can do to prevent chargebacks.

Why are billing descriptors important?

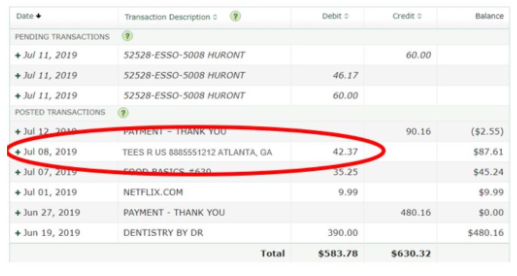

Do you know how the billing descriptor reads on your customers’ statements? Is it clear enough to prevent a customer from questioning the transition? Since customers will depend on the billing descriptor to identify a transaction, if it’s unclear, they will be much more likely to suspect fraud, and to file a chargeback as a result.

Consider a time when you were reviewing your credit card bill and discovered a charge you didn’t recognize. You thought about it for a while but couldn’t remember the name of the firm or the price you paid for the product or service. What was your initial reaction? Mostly likely that your card had been compromised and that you needed to contact your credit card company and file a report.

Your customer will do the same. He or she will phone the bank’s customer service and explain that there’s a charge that is unrecognizable. This call will result in a chargeback and begin a procedure that will take time and be costly for you to correct. Not only will you lose the sale’s revenue while the chargeback is being investigated, but you’ll also be charged chargeback fees that you won’t be able to refund.

Here are the types of descriptors to consider for customer billing statements. These descriptors are fixed in length; standard credit card transaction descriptor length is 22 characters max. It will generally include the DBA name of the merchant and the name of the product or service, separated by an asterisk. Some processors allow for the merchant’s telephone number or website as well.

Consult with your processor for more information about descriptors.

Types of billing descriptors

There are three types of billing descriptors: A default billing descriptor, dynamic billing descriptor and a soft billing descriptor.

Default Billing Descriptor

The default descriptor (also known as a static or hard descriptor) usually consist of two elements, business name and contact information. It appears on your customer’s statement once the transaction has been settled and is the same for every transaction processed. The hard descriptor will also include the total cost of the final transaction.

A default billing descriptor is sufficient if:

- Your business provides only a single product or service.

- Your customers will understand a static value for any transaction with your business.

- You prefer to provide the same statement descriptor for all transactions.

For example, TEES R US 888-555-1212 Atlanta, GA

Dynamic Descriptor

A dynamic descriptor allows for the description to provide a more detailed information about the transaction, in addition to the business name and phone number. This type of descriptor may be the better option for businesses with multiple product lines or service offerings.

A dynamic descriptor is necessary if:

- You provide multiple products or services.

- Your customers might not understand a single value for all their transactions with your business.

- You prefer to provide transaction-specific details on the statement descriptor.

For example:

TEES R US WMNS TANK 888-555-1212 Atlanta, GA

vs.

TEES R US MENS SHIRT 888-555-1212 Atlanta, GA

Soft/Pending Descriptor

A soft (or pending) descriptor is displayed after a transaction has been authorized but is not yet captured. A customer can see it when the charge has a pending status. The information displayed is usually the same as for the default descriptor, but some issuing banks display the payment service provider name instead of the merchant’s name. It’s worth noting that pending transactions can’t be disputed. The hard descriptor replaces the soft descriptor once the transaction is finalized.

Whether you choose to go with the default or dynamic descriptor, check with your processor to ensure that your business name is displayed correctly. It should be your DBA, which is how your customers know you, not your legal name. If abbreviated, make sure the name is recognizable or request an alternative abbreviation. Check the phone number as well and make sure it is accurate.

To sum it up:

- A billing descriptor is the explanation of a transaction that appears on a customer’s credit card statement.

- A merchant’s billing descriptor impacts how customers identify transactions. Clear descriptors will reduce chargebacks and help maintain good customer relationships.

- Whether you choose to go with the default or dynamic descriptor, check with your processor to ensure that your business name is displayed correctly.