During the past few years, payment gateways have stepped out from behind the scenes to play a leading role in how companies provide customers with improved methods for online and digital payments.

This emergence is certainly driven by the increase in consumer adoption of online payments. In fact, according to a report by Mordor Intelligence,

“When comparing online/e-commerce (no card present) payments with card-in-hand payments, digital proved to be the higher growth category, accounting for growth up to 23%, over the last year.”

[Mordor Intelligence, DIGITAL PAYMENTS MARKET – GROWTH, TRENDS AND FORECAST (2019 – 2024)]

A recent shift in business models is also having an impact. Taking a cue from the Software-as-a-Service industry, companies have realized the financial benefits of recurring revenue. This has resulted in more companies offering their products and services through a subscription model. Customers pay a monthly fee and receive a regular delivery of clothing (StitchFix, Trunk Club), pet supplies (Barkbox, Chewy), food (Blue Apron, Harry & David), or personal care items (Dollar Shave Club, Birchbox.)

When choosing or re-evaluating a gateway partner, take the following five criteria into consideration:

1. Ease of Integration

2. Ease of Migration

3. Security

4. Customer Service

5. Features

1. Ease of Integration

When a customer uses a credit card to pay for your goods or services, or make a donation, the transaction must be authorized by the bank that issued the credit card. This ensures that credit is

available to the cardholder and that the purchase amount is within the cardholder’s credit limit.

2. Ease of Migration

If you’re moving from one provider to another, migration should be as easy and seamless as possible for everyone involved. It should include a secure transfer of all account information, such

as customer names, address, credit card numbers, expirations and so on. Consider timing implications, as you want to minimize disruptions for you and your customers. Make sure you plan for any needed software upgrades. If your systems are up to date, the switch is simpler.

3. Security

When it comes to taking payments, security is paramount as is compliance. Many online retailers don’t realize they, like their brick-and-mortar counterparts, are required to meet standards set by

the Payment Card Industry Data Security Standard (PCI DSS). Point-to-point encryption (P2PE) is one of the best methods you can use to protect yourself, as well as your customers, and prevent a credit card breach. While P2PE has been around for many years, only PCI-validated P2PE technologies have been tested to the rigorous standards and should be trusted to reduce risk and PCI DSS scope at a merchant.

The simplest way to ensure you’re protected is to partner with a company listed as a Point-to-Point Encryption (P2PE) provider. This way you can verify the gateway is both certified and PCI-compliant. You also want to protect your company against credit card fraud. At a minimum, the gateway you’re considering should encrypt data at the time of transaction, offer address verification and be security code configurable. It should also be able to check and block transactions, be configurable by transaction source since the characteristics of transaction risks vary by source.

4. Customer Service

Every payment service company will tell you they know the various systems and how they work. Well, they should. The question to ask is “how satisfied their customers are with the level of service they’re receiving?” Problems happen, and how quickly they’re resolved could be the difference between you keeping a customer and you losing one. When vetting a company, check to see where their support team is located. Ask if you’ll receive personalized service, or will you be re-directed through a series of menus. The more time you spend trying to get service is less time

you have to serve your customers.

5. Features

If you run a subscription or recurring revenue business, make sure your payment gateway has features such as fraud protection, account updater and Level III processing.

BONUS: Pricing Models

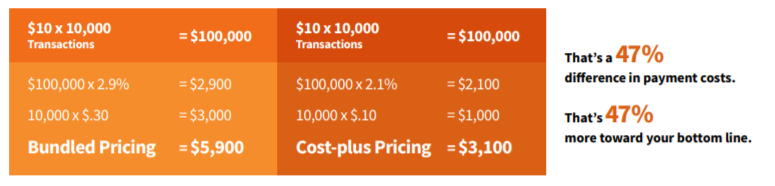

Almost all payment gateways offer merchant accounts as part of their services. Most offer an all-in-one blended rate for the gateway and the merchant account service. Companies usually advertise 2.9% plus $.30 a transaction*. This model seems pretty straightforward and is convenient.

However, not all gateways require you to sign up with their merchant in order to get the gateway. These providers are system agnostic and can code their gateway to any acquirer or processor. You can bring your own processor on board if you wish or sign on with one of theirs.

There are many advantages to this. You have flexibility – build the solution that will work best for your business. You’ll also benefit from cost-plus pricing. Instead of a blended percentage rate, you pay the published interchange rate, a per transaction fee and basis points (one basis point is 0.01%). When you run the numbers, cost-plus pricing tends to offer significant savings over bundled pricing.

Bundled Pricing vs. Cost-plus Pricing

Here’s an example to give you an idea of the difference in pricing methods

using an average of $10 per transaction, and 10,000 transactions per month.

Final Decision

Making decisions that impact your business – and how you go about doing your business – are never easy. Hopefully, our insights on what to consider when choosing a gateway partner help with your choice. If you have any questions or want to talk to someone with 35-years of experience in the card-not-present industry, give us a ring at 800.457.9932.

Already have a partner? That’s okay. There’s never a bad time to assess your payment processing options. After all, the less you spend on payments, the more you can spend on your business.

*Braintree and Authorize.net published pricing as of November 25, 2019

**2.1% is an average of Card-Not-Present interchange rates published by Visa® and Mastercard®